Published in Pensions Expert 2nd June 2015

No wheel-spinning Lamborghinis just yet

From the blog: Here we are in the new era of pension flexibilities and I can’t help but be surprised at the number of Lamborghinis still listed in the classifieds.

So while our pensioners have chosen to ignore our ex-pension minister and not blow the lot on a supercar, it does beg the question: what have they been doing with their pension pots since April?

Our statistics showed member requests started well before April, with enquiries soaring since the turn of the year. One pension administration office reported a 450 per cent increase in call volumes.

Interestingly, many had little or no idea whether they were in a defined benefit or defined contribution scheme, or what the regulations actually allowed. Detail was largely irrelevant to them – cash is king.

And so the transfer-out quotations flowed, but not before processes were rewritten and communications restructured to include Pension Wise and other protection afterthoughts.

Throughout this process requests have been studiously tracked to uncover any trends to ensure appropriate resource planning. So what has the data uncovered so far?

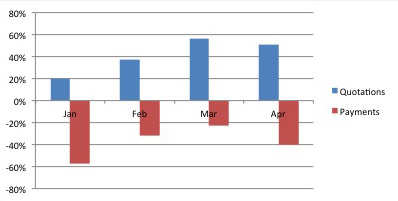

Source: Buck Consultants

Tracking the monthly requests against the previous year’s average, transfer-out quotations have been steadily rising and peaked at almost 50 per cent higher in March and April than in 2014.

Isolating the DB requests from the total number of requests provided an even higher result, stretching towards a 60 per cent increase.

Naturally, this has put all administration units under considerable pressure, especially given the short turnaround time to digest the legislation and then prepare the new transfer packs.

However, transfer settlements actually went down in the same period.

So while the rush to obtain the numbers was evident, prudence among members prevailed.

Transfer amounts…

Source: Buck Consultants

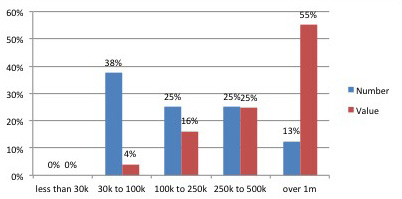

It’s also been an interesting exercise to analyse the actual transfer value amounts that have been quoted, albeit using a limited dataset.

It’s far too early and also extremely difficult to make judgments, but so far the requests have resulted in no transfer-out quotations being produced for members with cash-enhanced transfer values under £30,000; roughly 90 per cent of the quotes spread fairly evenly up to £1m, but 10 per cent of the quotes being in excess of £1m.

That 10 per cent accounted for more than 55 per cent of the total transfer value amount quoted. So while there may be more traffic in the lower end of the CETV scale, trustees should be mindful of large settlements impacting cash flow or scheme funding.

So in summary, trustees and their administrators are working hard to provide freedom and choice, but it’s been a measured start from members to adopt pension flexibilities.

So no wheel-spinning in Lamborghinis just yet – more like a sedate drive down Retirement Boulevard.

http://www.pensions-expert.com/Special-Features/No-wheel-spinning-Lamborghinis-just-yet

No comments:

Post a Comment